In 2016, St.George Bank engaged me to help address high drop-off rates in their online credit card applications. Using a Human-Centered Design approach and the Double Diamond framework, I collaborated with cross-functional teams to identify pain points, prototype solutions, and conduct user testing. We streamlined the application flow, introduced instant account creation, and provided early credit limit feedback. The result was a shorter, more intuitive experience that boosted conversion rates and customer satisfaction.

Year: 2016

Client: St.George Bank

My Role: UX Consultant

THE CHALLENGE

St.George and Westpac’s online credit card applications were underperforming, with 550,000 customers initiating applications but failing to complete them. This gap represented a significant opportunity to optimise the conversion rate within the sales funnel process.

The business objectives for this 3-month feasibility study included:

- Simplified credit decisions

- Early online banking access prior to account approval

- Integration of new card services within online banking

- Targeted messaging to customers

- Instant account creation

THE APPROACH

To address the challenge, I utilised a Human-Centered Design (HCD) approach, employing the Double Diamond framework to guide the project. This approach focused on understanding user needs, ideating, prototyping, and testing solutions iteratively.

Discover & Define

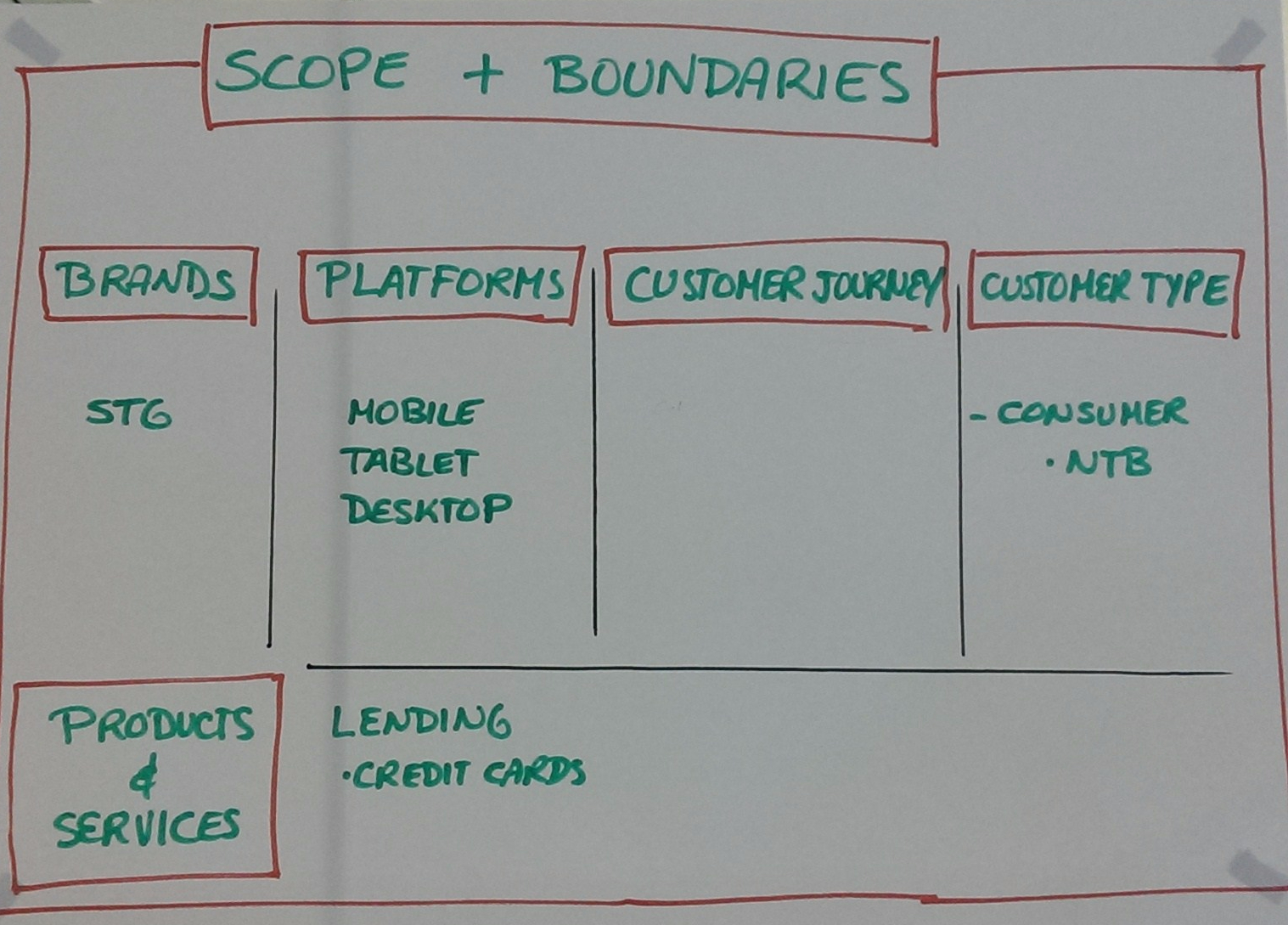

- Defining the Opportunity and Scope:

The first phase involved gathering insights from key stakeholders and defining the core problem areas. By analysing existing user behaviour and feedback, we identified friction points and opportunities to streamline the application process.

- Stakeholder Engagement:

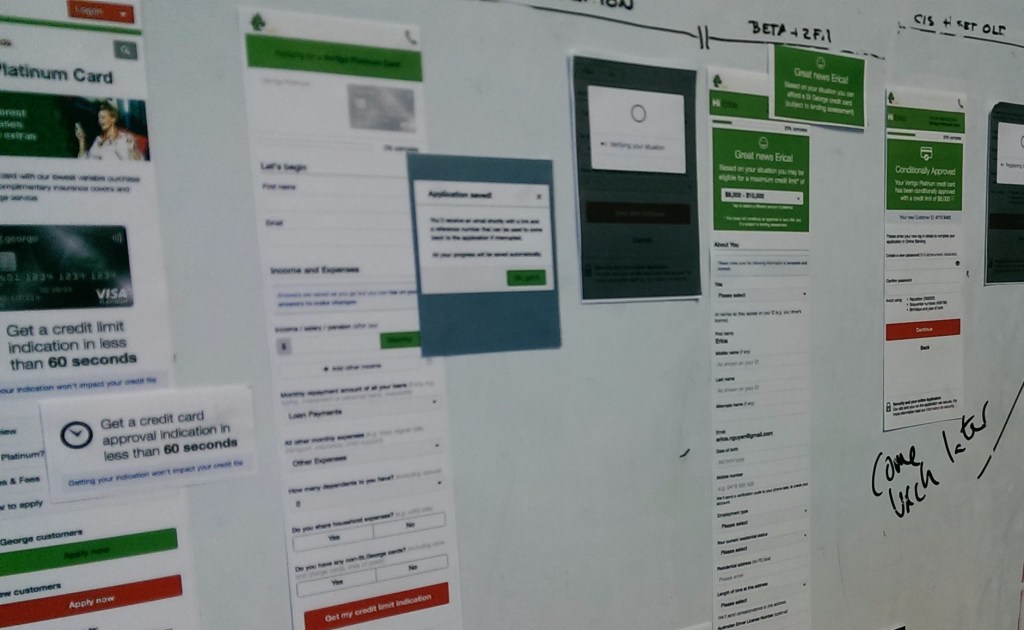

I set up and maintained the Design Wall—an interactive tool that visually mapped out the user journey and engaged stakeholders throughout the process. This allowed for ongoing alignment and collaboration across teams.

Develop

Prototyping:

In collaboration with the Product Owner, Scrum Master, and Business Analysts, I led the design and prototyping phase using Axure. This allowed for a rapid, iterative process to test and refine concepts before moving into development.User Testing:

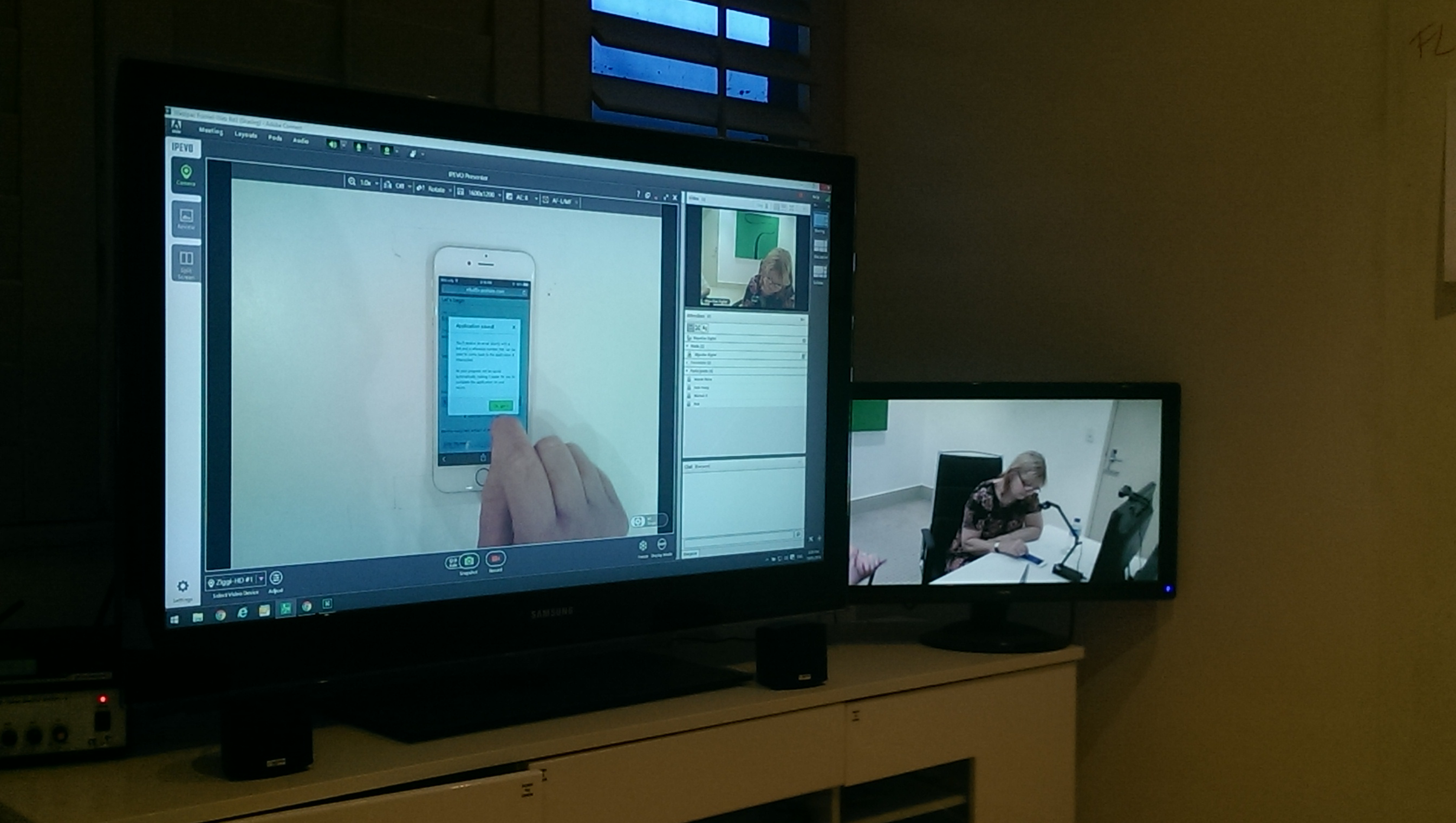

We engaged one of Westpac’s preferred research partners to conduct user testing, validating our assumptions and collecting feedback on prototypes. This ensured the solutions met both business objectives and user needs.

Deliver

- Refining the Solution:

Based on user feedback, we fine-tuned the online credit card application flow, making it shorter and more intuitive. We incorporated early feedback on credit limits, allowing applicants to feel that their time was valued, and integrated a feature for users to explore limited product options within online banking. Instant account creation provided a seamless experience, ensuring users could start exploring their new account immediately.

THE OUTCOME

The final product resulted in an optimized online credit card application flow that was both shorter and easier to complete. Key features included:

- Instant Account Creation: Enabling new customers to access basic services immediately after applying.

- Early Feedback on Credit Limits: Helping users feel confident in their decisions by providing upfront information on credit limits.

- Digital Card Concept: A digital card available for immediate use on online purchases while the physical card was in transit.

This solution increased the conversion rate and enhanced user satisfaction, turning a previously underperforming process into a seamless and efficient journey.

Axure Prototype