In 2015, Westpac aimed to reduce a 45-minute in-branch account opening process to match its 5-minute online equivalent. As CX Senior Consultant, I co-led a five-month project focused on redesigning the in-branch experience using human-centred design and the Double Diamond framework. I led concept design, prototyping, and user validation while collaborating on journey mapping and stakeholder engagement. The outcome was a streamlined process that enabled staff to open both transactional and savings accounts in under 10 minutes. This transformation improved operational efficiency, enhanced customer and staff experience, and laid the groundwork for future service innovation.

Year: 2015

Client: Westpac Australia

My Role: CX Senior Consultant

THE CHALLENGE

Westpac faced a critical question: If a customer can open a transactional account online in 5 minutes, why does it take 45 minutes in a branch?

Branch processes, systems, and KPIs were making it difficult for personal bankers to serve customers efficiently, especially time-sensitive ones (e.g., during lunch breaks). The challenge was to optimise branch workflows by:

- Leveraging the streamlined online application process.

- Reducing the effort required for branch staff.

- Enhancing the in-branch customer experience.

THE APPROACH

I worked together on this project with another consultant from another agency whose main focus was the mapping of the as-is and the recommended journey maps, while my focus was driving the concept design, creation of artefacts (in this case a prototype) and user validation.

We adopted the Double Diamond framework and HCD principles to structure the project into four key stages: Understand, Define, Design, and Build & Deploy.

Understand

Among the activities we did here were:

- Stakeholder Workshops: Aligned goals and identified operational challenges.

- Field Research (In-Branch): Observed staff workflows and customer interactions in real-time.

- Technology Workshops: Assessed system limitations and integration opportunities.

- Desk Research: Analyzed competitor approaches to identify potential improvements.

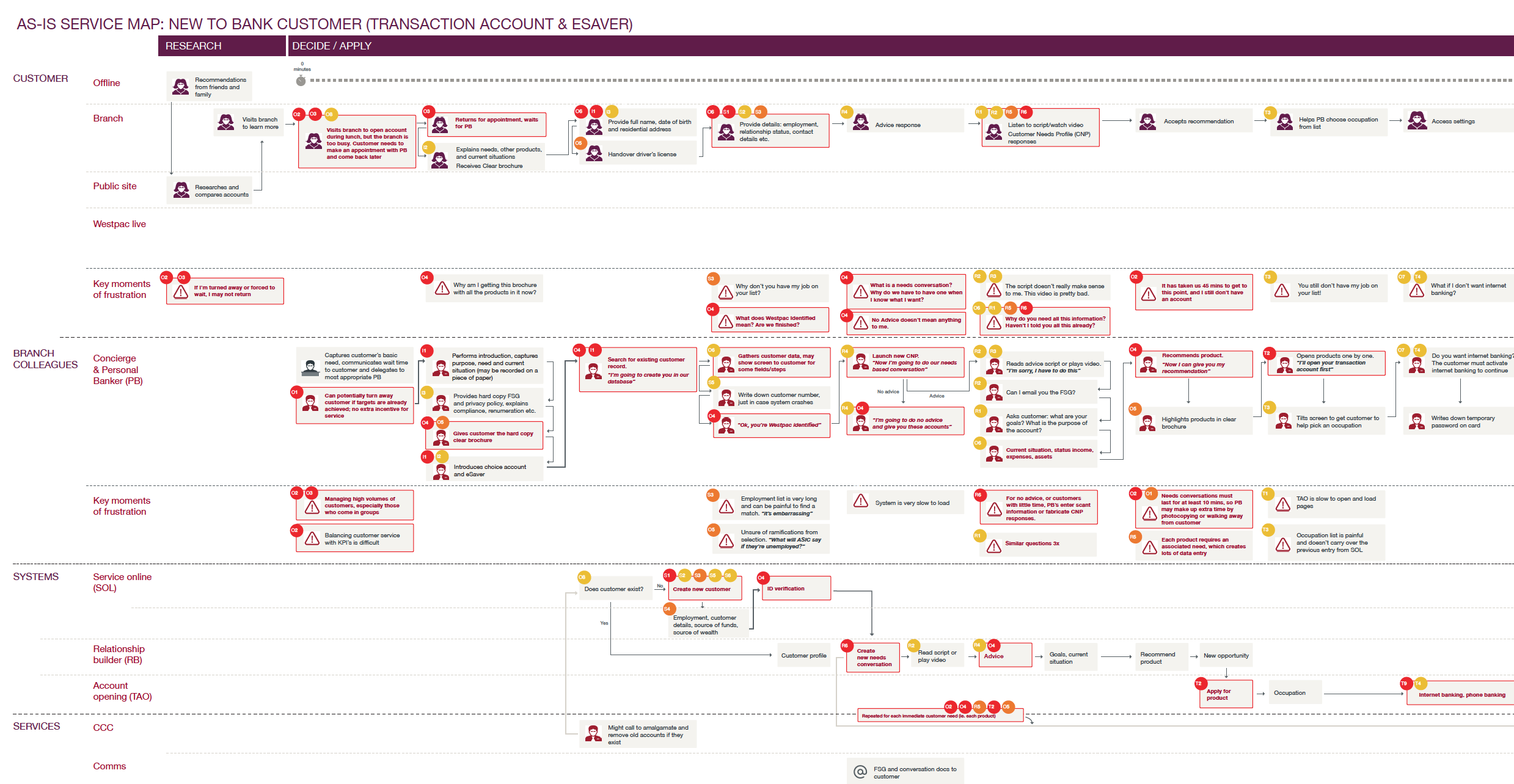

- As-Is Journey Mapping: Visualised the current state of the customer and staff experience to identify inefficiencies.

Define

In this phase, we synthesised findings and prioritised opportunities:

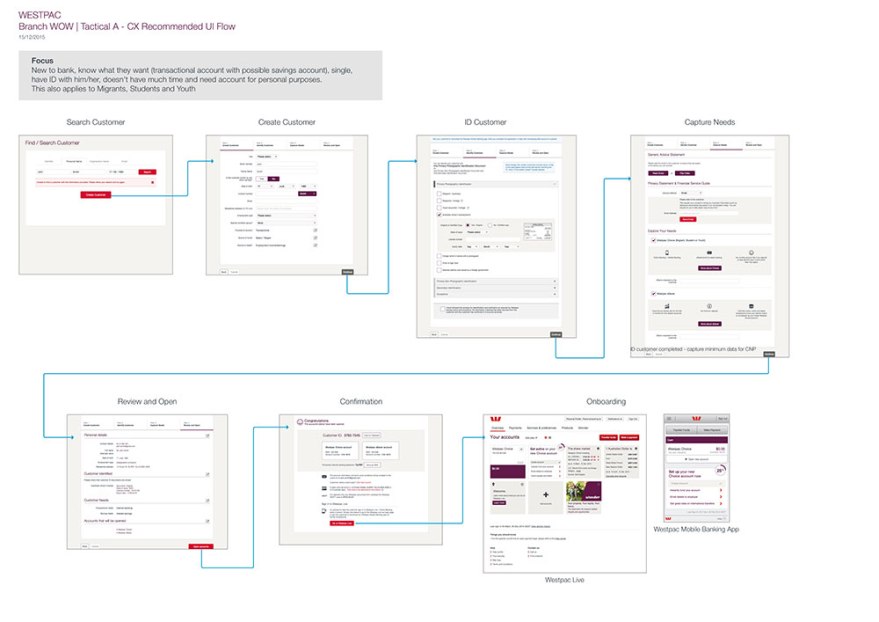

- Ideal State Journey Mapping: Designed a future-state journey that streamlined the in-branch account opening process.

- Opportunities Prioritisation: Identified quick wins and long-term enhancements.

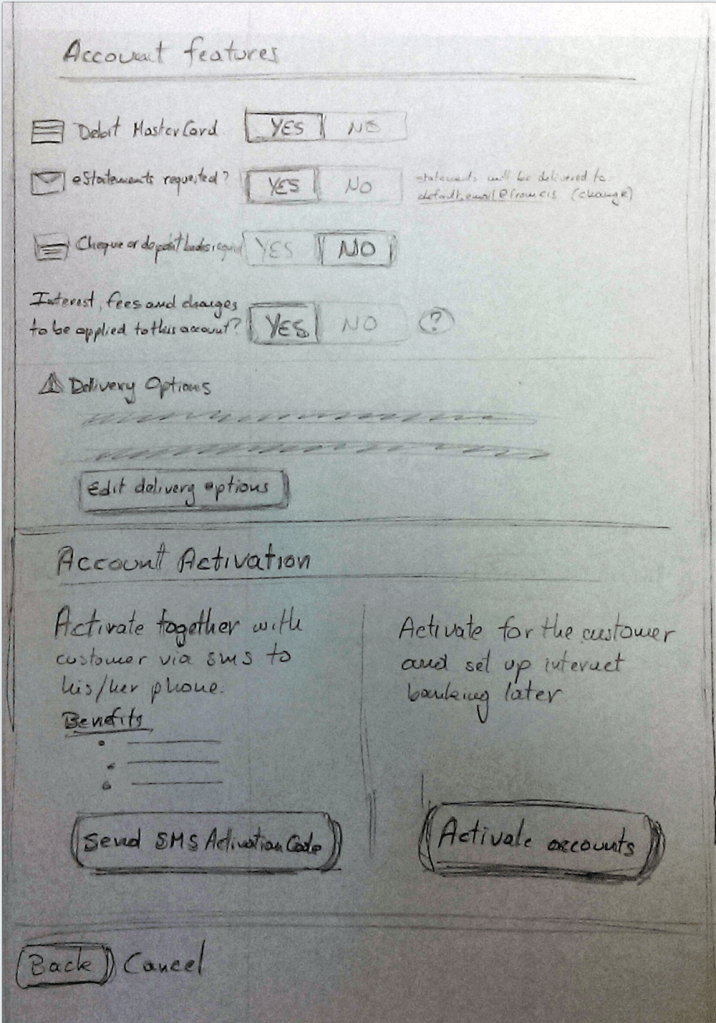

- Sketching: Created initial concepts for testing and refinement.

Design

We collaborated closely with stakeholders and end-users to iterate on designs:

- Co-Design Sessions: Engaged staff and stakeholders to refine the ideal state journey.

- User Journeys: Detailed the steps for customers and staff in the new workflow.

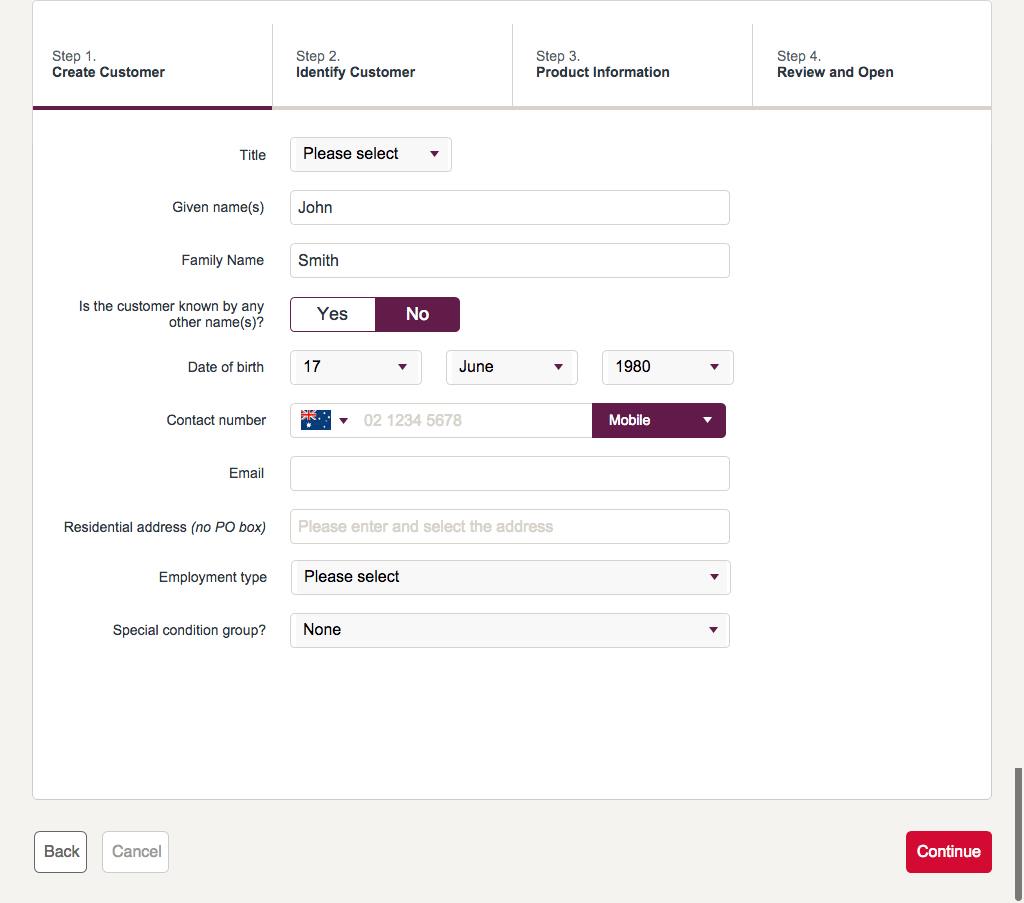

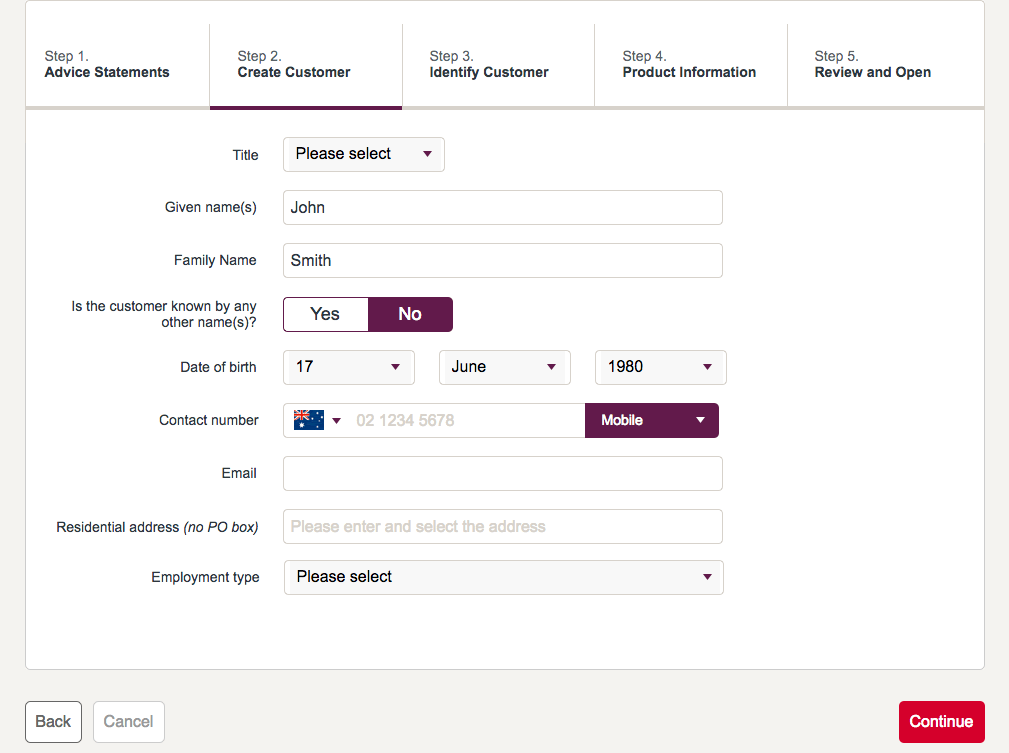

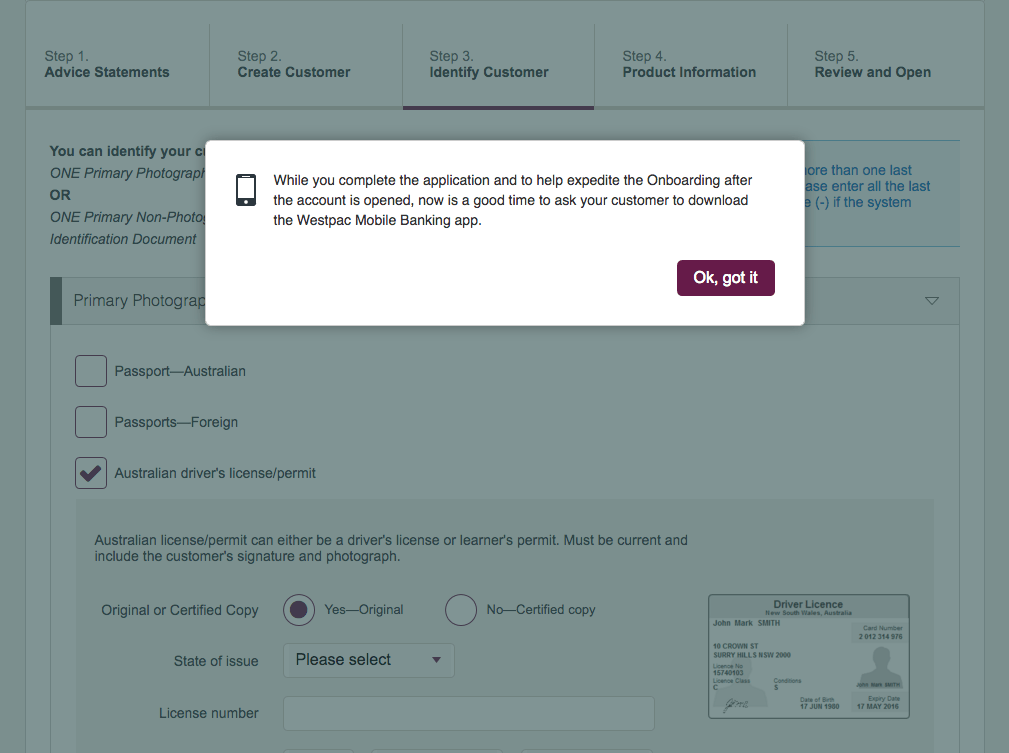

- Prototyping: Created interactive prototypes to test proposed solutions (contact me for access).

- User Testing: Conducted testing with personal bankers and customers to validate and refine the workflow.

Built and Deploy

The final stage focused on preparing the solution for rollout:

- User Stories: Delivered clear requirements to the development team.

- Pilot Development: Supported the agile team in building and piloting the solution.

- Actively collaborated with Compliance, Legal, and Change Management teams to ensure alignment and smooth implementation.

THE OUTCOME

The new streamlined process allowed personal bankers to open a transactional account, with cross-selling of a savings account, in less than 10 minutes—a dramatic improvement over the previous 45-minute process.

Key outcomes included:

- Improved Efficiency: Freed up time for personal bankers to focus on onboarding customers and setting up online accounts.

- Enhanced Experience: Both staff and customers described the process as more intuitive and efficient during testing.

- Cross-Functional Engagement: Ensured seamless collaboration across departments for successful delivery.

By leveraging insights from customers and staff and applying HCD principles, we exceeded expectations, delivering a faster, more customer-centric branch experience.